Everything you need to know about tax in Australia

People relocate to Australia for a variety of reasons. Some go simply to study or work temporarily, while others wish to move down under on a more permanent basis.

If you are planning to live, work or travel in Australia, there are some important points you need to know about your tax obligations. This FAQ style guide will outline everything you need to know about your Australian tax requirements and entitlements.

How does the tax system work in Australia?

Australia has a ‘pay-as-you-go’ (PAYG) withholding tax regime (similar to PAYE in the UK and Ireland) – in short, employers collect tax from the payments they make to employees and contractors and send it to the Australian Tax Office (ATO).

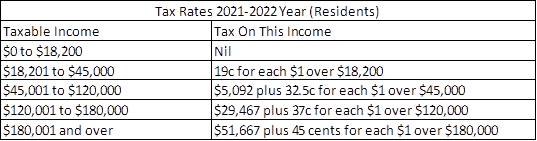

Australia has a progressive tax system, this means that the higher your income, the more tax you pay. Good news is that you can earn up to $18,200 in a financial year and not pay tax! This is known as the tax-free threshold and after which, the Australian tax rates kick in, more on these rates below.

What do I need to have to start a job in Australia?

To be able to work in Australia you must obtain a Tax File Number or, if you are self-employed, an Australian Business Number. A tax file number (TFN) is your personal reference number in the tax and superannuation systems in Australia.

To avoid being emergency taxed when you start working you need to provide your Tax File Number (TFN) to your employer within the first 30 days of starting work. Read more about TFN and ABN here.

Am I required to pay tax in Australia?

The simple answer is – Yes.

Your employer is responsible for deducting the correct amount of tax from your earnings depending on your residency status for tax purposes.

Individual tax rates for residents are as follows:

The above rates do not include the Medicare levy of 2%.

Non-resident or foreign residents for tax purposes (individuals who spent under 6 months in Australia) are required to pay higher amount of tax – starting from 32.5% of gross earnings.

What are the differences between Australian resident or non-resident for tax purposes?

Australia taxes you differently depending on whether you are an Australian tax resident or a non-resident. These differences can make a significant impact on the after tax proceeds one receives.

The main requirement to be deemed a resident for tax purposes is that you have continuously resided in Australia for a period of 183 days (6 months). If you spend less than the required time, you will be deemed a non-resident for tax purposes and you need to pay a higher tax rate, plus you are unable to use the tax-free threshold in your tax return and pay tax on each dollar you earn Down Under.

Working Holiday Makers are generally considered non-residents for tax purposes (unless they show strong residential behaviour and sufficient ties in Australia) and have special tax rate withholdings that start from 15% and progress to 32.5% + a fixed amount for income over $45,000.

Do I have to file a tax return in Australia?

The short answer is yes. Everyone who lives and works in Australia is required to declare their earnings. It makes no difference how many hours you work or what type of visa you have.

Regardless of the income earned, anyone who works in Australia is required to file a tax return at the end of the fiscal year.

What documents will I need to file my tax return?

In order to file your tax return you may need the following list of documents, therefore, it is important to keep them safe.

- Your final payslip from each job you worked in

- If you are self-employed, you will need invoices for each job you completed

- You will need proof of Australian address, this can be found on bank statements or utility bills

- Receipts from work-related expenses, e.g. certain work uniforms or work courses

- Home office expenses receipts

When is the deadline for filing my tax return?

The Australian financial year runs from July 1 to June 30, and the deadline to file your tax return and claim a refund is October 31.

Tax returns for the previous fiscal year can be filed at any time between July 1 and October 31. You may face a penalty if you do not file your tax return within this timeframe.

You can make an early statement if your visa expires before the end of the fiscal year or if you plan to depart the country before June 30.

Certified accountants and tax agents benefit from tax filling extensions. These extensions can help you avoid penalties and fines for not lodging your tax return on time.

What happens if I don’t file a tax return?

It’s important to file your tax return before the tax deadline – 31 October. After all, if you miss the deadline, you may incur fines and penalties from the Australian Tax Office.

If your tax affairs are not in order, this could negatively affect your future visa applications.

How to file my Australian tax return?

You have two options to choose from:

1. You can file your tax return with the Australian Taxation Office directly on your own. The downside of this is that you will be dealing with the overwhelming and tricky tax paperwork, and you may not avail of all the tax deductions that you are entitled to. It will be your full responsibility to file a compliant tax return with the ATO.

2. Use the help of a tax professional. The tax experts from Taxback.com can give you experienced tax advice and help. They will handle all of the paperwork, send your maximum refund directly into your bank account anywhere in the world, and keep you in compliance with the ATO.

What is superannuation?

Superannuation is a payment system for employees in Australia that allows them to receive payment to replace their income once they retire.

Your employer will pay 10% (from July 2021) of the value of your regular earnings into a super fund if you are aged 18 or over and earn more than $450 a month.

If you decide to leave Australia or have already left, there is a chance you can reclaim your super depending on how long you worked in Australia for and the amount your employer has contributed to the fund.

Who can help me with my Australian tax refund and superannuation claims?

Taxback.com is a trusted and reliable tax service provider for more than 25 years in Australia. They lodge hundreds of tax & superannuation returns annually. Their team of professionals will help you claim any tax credits you are entitled to and ensure you receive your maximum legal tax refund.

Why Taxback.com?

- Simple and quick online process

- ATO compliance guaranteed

- Maximum refund transferred straight into your bank account, anywhere in the world

- 24/7 live chat to help answer any tax queries you may have

- Taxback.com can help you find any missing documents you may need